Lumber prices have tripled since June 2020, adding an average of $24,000 to the price of a new US home; and reports from Canada show that timber poaching is increasing as a result.

Sawmills were idle during the pandemic lockdown, so the usual inventory build over winter did not happen. These technical constraints on supply are colliding head on with a spike in demand as housebuilding restarts, with the added pressure of the post-COVID desire for larger houses.

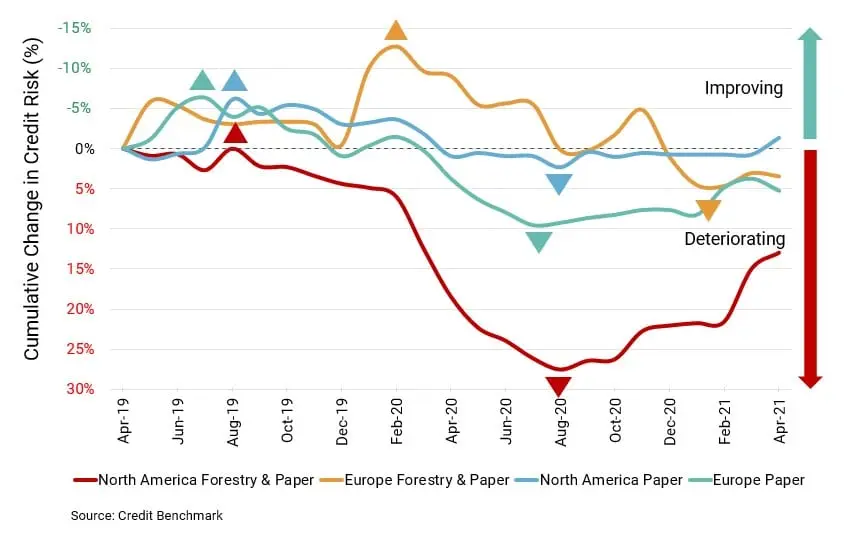

Figure 1 shows Forestry and Paper credit trends over the past two years.

Figure 1: Consensus Credit Trends in Forestry and Paper by Region

The impact of COVID was uneven – North American Forestry and Paper deteriorated by about 25%, whereas North American Paper showed no change; suggesting that Forestry took the brunt of the downgrades. The recovery is almost as dramatic, with credit risk rapidly returning to pre-COVID levels.

European Forestry and Paper showed a mild increase in credit risk – just over 5% – and unlike North America, Paper increased slightly more – about 10%.

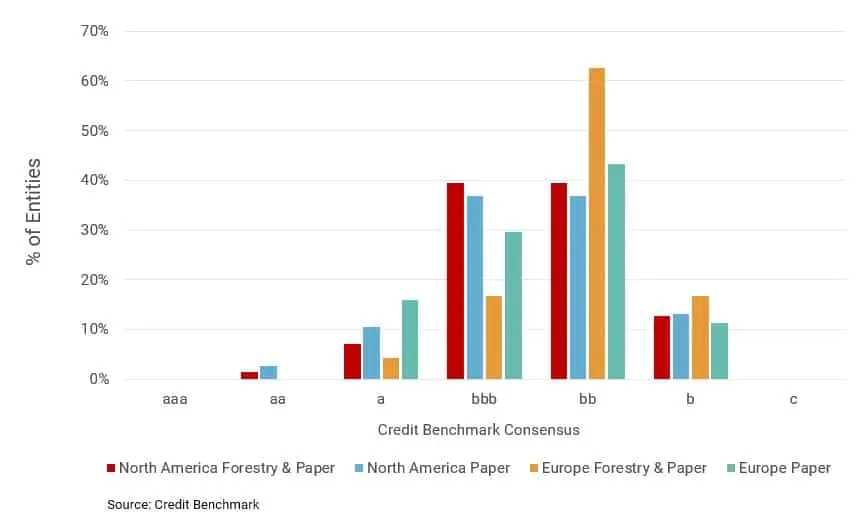

Overall, this industry is credit-robust – the majority of the North American Forestry & Paper universe is in the bbb or bb categories, with a few in aa, about 10% in a and another 10% in b. There are no names in the c category.

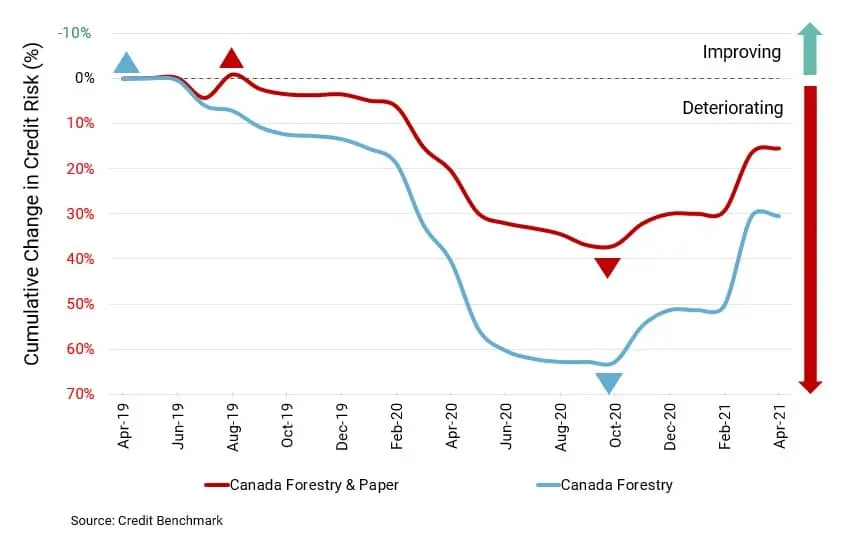

Canada and Forestry are inseparable; Figure 2 shows the impact of COVID on the Canadian Forestry and Paper sectors.

Figure 2: Consensus Credit Trends in Canadian Forestry and Paper

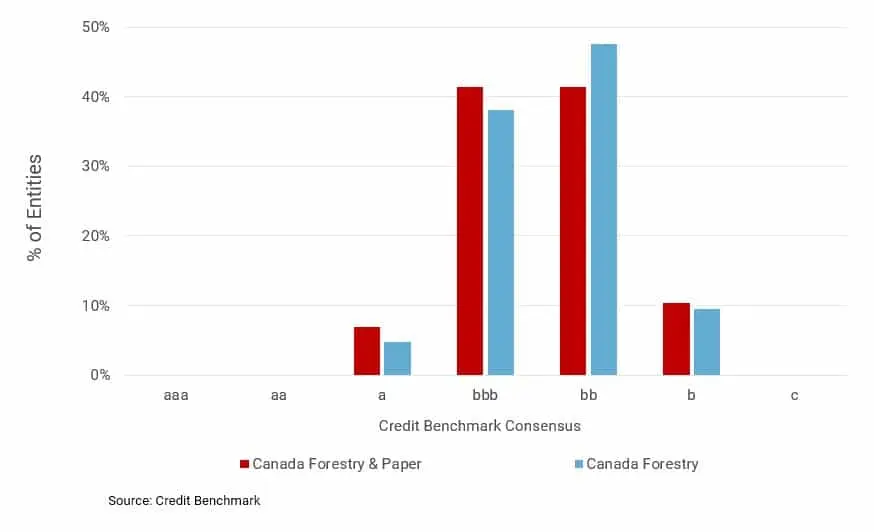

The credit distribution mirrors that of North American Forestry & Paper, but Canada’s Forestry sector shows a significant (+40%) increase in credit risk during the COVID period. As with the North American aggregate, the recovery has been rapid.